ChitChat, developed in collaboration with global payments leader Mastercard, enables users across Africa to communicate securely through its encrypted platform while facilitating money transfers via its digital wallet functionalities.

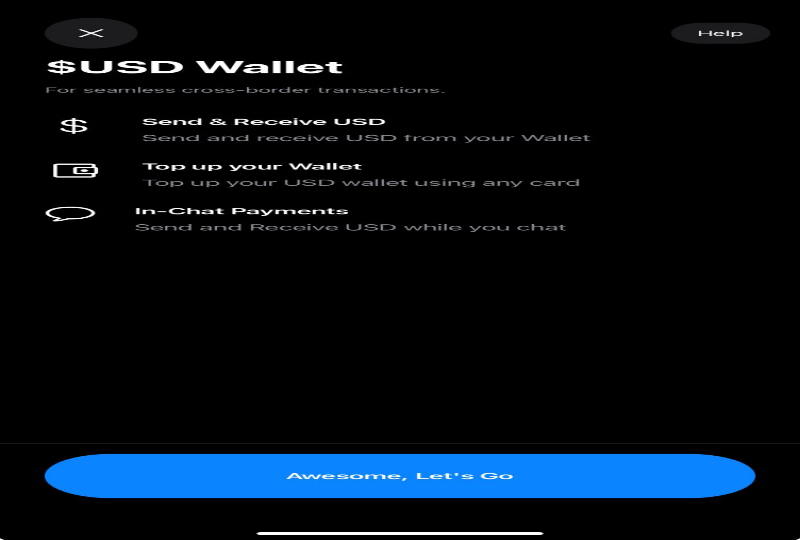

Union54, a pan-African digital solutions provider and debit card issuer, anticipates that the app will facilitate real-time USD payment transfers directly within chat conversations.

Furthermore, the platform will offer the added convenience of in-app currency conversion between USD and Zambian Kwacha (ZMW).

Perseus Mlambo, CEO of Union54, emphasizes that ChitChat’s core principles are to serve as a “safe, secure, and sovereign platform for social commerce”.

“We aim to grow ChitChat into a platform that accelerates commerce across Africa,” Mlambo added.

Union54 aims to rapidly expand the app’s features, with upcoming plans to introduce group wallets in the coming weeks.

By integrating communication, financial transactions, and bill payment into a single platform, ChitChat holds the promise of fostering economic growth, stimulating entrepreneurship, and advancing financial inclusion across Africa.

In June 2023, Union54 unveiled plans for Mastercard integration, which would enable ChitChat to offer its card and payment features in beta for Angola, Tanzania, and Ghana, with intentions to expand to other markets in the future.

However, following an attempted $1.2 billion chargeback fraud, Union54 ceased its services, prompting African startups that previously utilised its card-issuing services to seek alternative solutions.

Mastercard views this as an opportunity to further promote financial inclusion in African markets.

Despite Zambia being regarded as a smaller eCommerce market with a projected revenue of US$126.7 million by 2024, it is expected to demonstrate a compound annual growth rate (CAGR 2024-2028) of 9.8%, leading to an estimated market volume of US$184.4 million by 2028.

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.