The initial rollout of Strike’s services includes Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia. Founded by CEO Jack Mallers, the company intends to expand its presence to additional African markets in the future.

Strike, a creation of the Chicago-based startup Zap, operates similarly to mobile payment applications such as Cash App or Venmo but leverages blockchain technology for transactions.

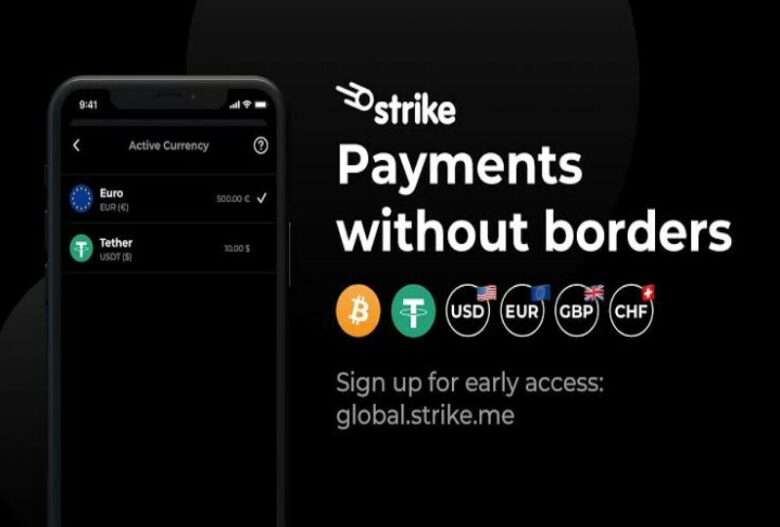

In these African countries, the application will enable users to participate in the buying and selling of Bitcoin (BTC) and the dollar stablecoin USDT.

Furthermore, it will offer local fiat currency on-ramps and off-ramps, along with global payments through Bitcoin’s Lightning network.

This network facilitates cost-effective and rapid transactions for both transfers and cross-border payments.

The launch of Strike Africa coincides with the growing popularity of Bitcoin and stablecoins in countries grappling with high inflation rates and unstable financial systems, such as Argentina and Turkey.

Significantly, Nigeria, the largest market in Africa, has witnessed a substantial increase in crypto adoption as people turn to digital assets to hedge against the devaluation of the local currency.

The Nigerian naira has seen a significant decline in value, plummeting nearly 50% against the U.S. dollar in recent times.

Strike’s decision to expand into Africa underscores the company’s perception of the continent as a promising environment for financial innovation and economic empowerment.

The rollout into Africa comes after Strike’s declaration last year to extend its operations to over 65 countries, targeting not just Africa but also Latin America, Asia, and the Caribbean. In November, Strike introduced its services globally, allowing users in more than 35 countries to purchase BTC through its app, albeit with a 3.9% fee for non-U.S. customers.

In recent developments, Strike CEO Jack Mallers disclosed his choice to fully divest from the U.S. dollar, underscoring his dedication to Bitcoin.

Mallers, renowned for his support of Bitcoin, scrutinized U.S. monetary policies and articulated his confidence in Bitcoin’s capacity to counteract fiat currency depreciation, emphasizing its fixed supply and decentralized structure.

His position mirrors a wider conviction in Bitcoin’s alignment with American principles such as individual liberty, equal opportunity, and innovation.

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.