As of September 18, 2024, data from the Central Bank of Nigeria (CBN) indicates that reserves are at their highest level since November 4, 2022, when they stood at $37.36 billion.

This signifies a notable recovery in Nigeria’s foreign currency position.

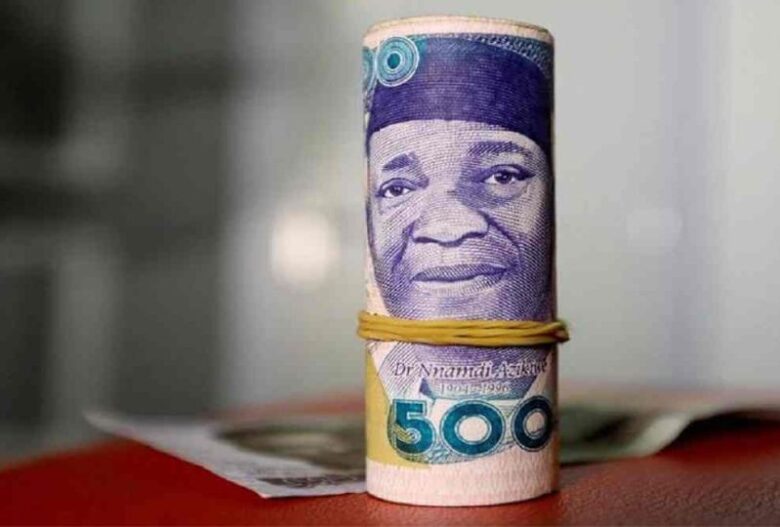

While the external reserves are crucial for assessing the country’s ability to meet international financial obligations and stabilize the naira, they have not effectively countered the currency’s decline. Bloomberg recently ranked the Naira among the world’s ten worst-performing currencies.

Year-to-date, Nigeria’s reserves have increased by 12.99%, or $4.29 billion, from $33.02 billion at the start of the year on January 2, 2024.

Key factors driving this rise include the federal government’s domestic dollar bonds, which have attracted foreign investment, as well as remittances from Nigerians abroad, multilateral loans, and foreign portfolio investments.

In a year-over-year comparison, the foreign reserves grew by 12%, adding $4.03 billion to reach $33.28 billion as of September 18, 2023.

The government raised over $900 million through the issuance of $500 million, the first tranche of a $2 billion domestic US dollar bond aimed at stabilizing the economy.

According to the CBN, the country received $553 million in remittances from July 2023 to July 2024. Additional inflows included a $3.3 billion oil facility from AfreximBank and $2.25 billion from the World Bank Group.

Foreign exchange inflows surged by 57% year-over-year, attributed to consistent CBN policies. In February 2024, Nigeria recorded $8.86 billion in FX inflow, an increase from $5.66 billion in February 2023.

The CBN’s economic report for February 2024 noted a significant rise in new investments, totaling $1.24 billion, compared to $0.33 billion in January 2024.

Foreign direct investment rose to $0.06 billion from $0.03 billion, while portfolio investment inflows increased to $0.80 billion from $0.12 billion, driven by higher returns on money market instruments and bonds.

Other investment capital, primarily loans, also grew to $0.37 billion from $0.18 billion in the previous period.

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.