Previously taxed at 7%, these items will now be free from VAT as a response to requests from industry professionals.

The exemption applies not only to school supplies but also to the raw materials used in their production.

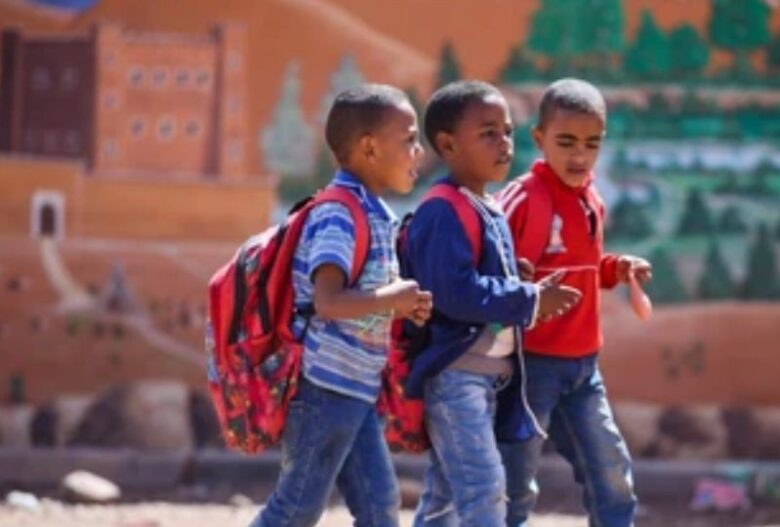

Imported school supplies intended solely for educational purposes are also eligible for this exemption. The updated list of VAT-exempt items now includes 36 products, such as notebooks, coloring books, adhesives (up to specific quantities), pencil sharpeners, modeling clay, paintbrushes, chalk, school bags, and pencil cases.

This initiative stems from the 2024 Finance Law, which eliminated the 7% VAT rate on these items.

According to the authorities, to benefit from the exemption, manufacturers must submit an electronic application detailing their intended purchases or imports and maintain an accurate account of materials.

The administration will issue a VAT exemption certificate to successful applicants, and all related sales documents must clearly state the VAT-exempt status.

For imports, a “VAT-Exempt Import” certificate will be issued to ensure that the supplies are used exclusively for educational purposes, with the certificate valid only for the year it is issued.

This bold initiative, rooted in the 2024 Finance Law, demonstrates the Moroccan government’s commitment to education and family welfare. By removing financial barriers to essential learning tools, Morocco is taking a significant step towards ensuring equal access to education for all its students.

As the new academic year approaches, families across Morocco can look forward to more affordable back-to-school shopping, thanks to this comprehensive tax exemption on crucial educational supplies.

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.