Ghana has secured an additional $600 million from the International Monetary Fund (IMF) as part of the first review of the $3 billion, 36-month Extended Credit Facility (ECF) Arrangement.

The IMF announced this in a statement on Friday, January 19, 2024.

The IMF stated that Ghana’s performance under the programme has been strong, noting that all quantitative performance criteria for the first review and almost all indicative targets and structural benchmarks were met.

“The authorities’ reforms are bearing fruit, and signs of economic stabilisation are emerging. Growth in 2023 has proven resilient, inflation has declined, and the fiscal and external positions have improved. Progress is also being made on debt restructuring, with the domestic debt exchange completed over the summer and an agreement recently reached on the restructuring of official bilateral debt,” IMF stated on Ghana’s economic reforms.

In the first review of the $3 billion, 36-month ECF Arrangement, which was approved by the board of IMF on May 17, 2023, as well as the 2023 Article IV Consultation with Ghana, the additional disbursement of SDR 451.4 million or $600 million brought Ghana’s total disbursements under the arrangement to about $1.2 billion.

The IMF believes Ghana is on track to lower the fiscal primary deficit on a commitment basis by about four percentage points of GDP in 2023.

“Spending has remained within programme limits. To help mitigate the impact of the crisis on the most vulnerable population, the authorities have significantly expanded social protection programmes. On the revenue side, Ghana has met its non-oil revenue mobilisation target.

“The Ghanaian authorities are also making good progress on their debt restructuring strategy. Their domestic debt restructuring was completed over the summer. On January 12, 2024, the authorities reached an agreement with the Official Creditor Committee (OCC) under the G20’s Common Framework on a debt treatment that is in line with Fund programme parameters. This agreement provided the financing assurances necessary for the Executive Board review to be completed.

“Ambitious structural fiscal reforms are bolstering domestic revenues, improving spending efficiency, strengthening public financial and debt management, preserving financial sector stability, enhancing governance and transparency, and helping create an environment more conducive to private sector investment.

“The authorities’ reform efforts are bearing fruit, and signs of economic stabilization are emerging. Growth in 2023 has proven resilient, inflation has declined, and the fiscal and external positions have improved.

“Looking ahead, fully and durably restoring macroeconomic stability and debt sustainability and fostering a sustainable increase in economic growth and poverty reduction will require steadfast policy and reform implementation,” IMF stated.

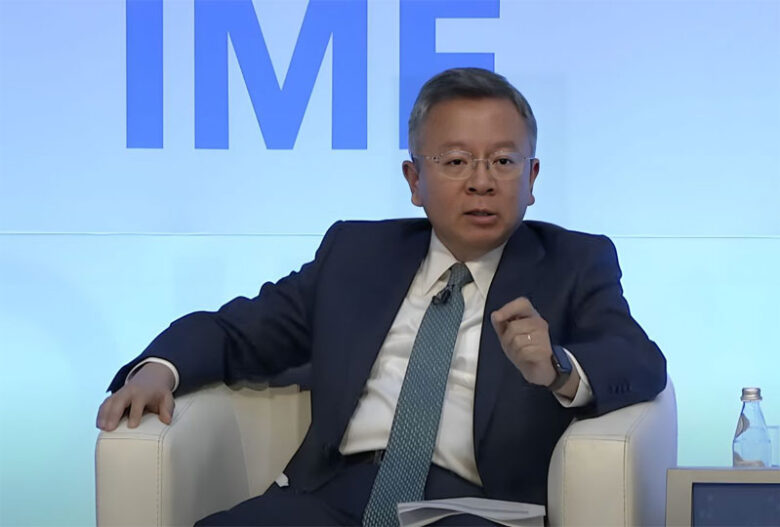

Managing Director and Acting Chair of the IMF, Mr. Bo Li, said restoring macroeconomic stability and debt sustainability, including fostering higher and more inclusive growth, require steadfast policy and reform implementation.

Li said Ghana’s plans to further reduce deficits by mobilising additional domestic revenue and streamlining expenditure to finalise its comprehensive debt restructuring are critical to underpin debt sustainability, and ease financing constraints.

“Sustained efforts to safeguard vulnerable populations and allocate resources for increased social and developmental spending remain crucial. Implementing reforms to enhance tax administration, reinforce expenditure control, manage arrears, strengthen fiscal rules and institutions, and improve the management of State-Owned Enterprises (SOEs) are imperative for ensuring lasting adjustments.

“The authorities have taken decisive measures to curb inflation and rebuild foreign reserve buffers. Maintaining an appropriately tight monetary stance and improving exchange rate flexibility are essential for achieving the program’s objectives.

“The Bank of Ghana has utilized regulatory and supervisory tools to mitigate the impact of domestic debt restructuring on financial institutions. The strategy employed by the authorities, focusing on sustaining a robust financial sector and leveraging new resources from the private sector, government, and multilaterals to swiftly rebuild financial buffers, is commendable. Ensuring the full implementation of bank recapitalization plans and addressing legacy issues in the financial sector will be crucial.

“Reforms aimed at creating a more favorable environment for private investment are necessary to boost the economy’s potential and support sustainable job creation. Given Ghana’s vulnerability to climate shocks, prioritizing a green recovery by advancing both the adaptation and mitigation agendas should remain a top priority,” emphasized Li.

YOU SHOULD NOT MISS THESE HEADLINES ON PRUDENCE JOURNAL

Jumia stops food delivery services in Nigeria and other African markets over profitability concerns

Tems opens up on pregnancy rumours with US rapper Future, says she got death threats

US House of Reps launches Republican impeachment inquiry against Biden

Afrobeat superstar Wizkid donates N100 million to children for Christmas

South African singer Zahara dies of liver complication at 36

Nigeria’s central bank to freeze accounts without BVN or NIN

Elon Musk blasts advertisers who pulled spending from X

70-years-old woman delivers twins after 40 years of barrenness

Israel Fails to Provide Evidence of Hamas Command Center in Al-Shifa Hospital Raid

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.