China’s banks approved $4.61 billion in loans to Africa last year, marking the first annual rise since 2016, according to an independent study released Thursday.

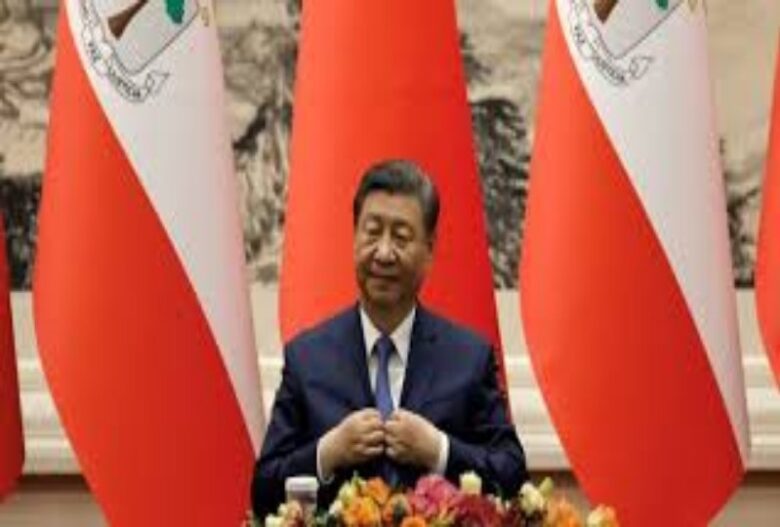

From 2012 to 2018, Africa received over $10 billion in annual loans from China, driven by President Xi Jinping’s Belt and Road Initiative (BRI), but lending sharply declined with the onset of the COVID-19 pandemic in 2020.

China’s lending to Africa surged more than three-fold last year to $4.61 billion, reflecting its shift towards minimizing risks tied to heavily indebted nations, according to a study by Boston University’s Global Development Policy Centre.

The centre, which manages the Chinese Loans to Africa Database project, noted Beijing’s apparent shift toward a more sustainable lending strategy.

The data precedes the upcoming Forum on China-Africa Cooperation, where African leaders will convene with China. In 2023, 13 loan deals were signed involving eight African nations and two multilateral lenders.

In 2023, China’s largest loans to Africa included nearly $1 billion from China Development Bank to Nigeria for the Kaduna-to-Kano Railway and a similar-sized liquidity facility to Egypt’s central bank.

Over the years, China has become the leading bilateral lender for countries like Ethiopia, providing $182.28 billion to Africa between 2000-2023.

The majority of these funds have been directed toward energy, transport, and ICT sectors, according to Boston University’s study.

In the early years of China’s Belt and Road Initiative (BRI), Africa played a central role as China aimed to extend its geopolitical and economic influence through infrastructure development.

However, in 2019, China began scaling back its financing, a trend hastened by the pandemic.

This pullback left several projects unfinished across the continent, including a modern railway intended to connect Kenya with its neighboring countries.

China’s reduction in loans to Africa has been driven by its own domestic challenges and increasing debt burdens in African nations. Since 2021, countries like Zambia, Ghana, and Ethiopia have undergone lengthy debt restructuring processes.

According to a Boston University study, over half of the $4.61 billion in loans provided by China last year, amounting to $2.59 billion, went to regional and national financial institutions.

“Chinese lenders’ focus on African financial institutions most likely represents a risk mitigation strategy that avoids exposure to African countries’ debt challenges,”The report explained.

The study revealed that nearly 10% of China’s 2023 loans were directed toward solar and hydropower energy projects, highlighting a shift in focus toward renewable energy over coal-fired power plants.

However, the trends in last year’s loans did not provide a definitive path for China’s future financial involvement in Africa, as loans were still granted to struggling economies such as Nigeria and Angola.

The Global Development Policy Centre noted, “It remains to be seen whether China’s partnerships in Africa will retain their quality.”

YOU MAY ALSO READ: Cameroon partners with exporters to ensure compliance with EU’s deforestation-free regulation

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.