This announcement comes weeks after the government was compelled to withdraw tax increases following widespread protests.

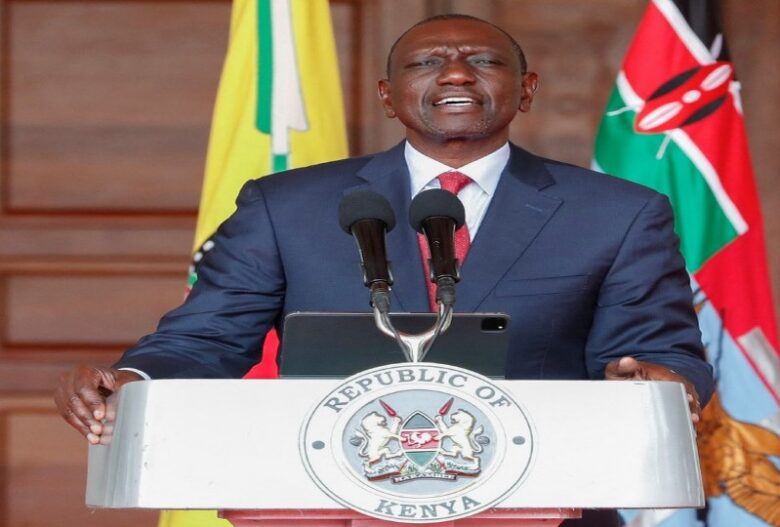

Last week, President William Ruto dismissed nearly his entire cabinet and committed to establishing a more inclusive government as part of his response to protesters’ demands.

Protests that started last month against the scrapped tax hikes escalated into demands for President Ruto’s resignation and substantial political reforms to combat corruption and improve governance.

Earlier this month, Ruto recommended a mix of budget reductions and new debt issuance to cover the nearly $2.7 billion deficit resulting from the cancellation of the tax increases.

Next week, as lawmakers return to parliament, they will be tasked with debating and approving the supplementary budget.

This budget, signed by principal treasury secretary Chris Kiptoo on July 11, has been made available on the parliament’s website.

According to Kiptoo, the supplementary budget estimates total spending at 3.87 trillion Kenyan shillings ($30 billion), reduced from an earlier projection of 3.99 trillion shillings ($31 billion).

He indicated that recurrent expenditures are anticipated to decrease by 2.1%, while development spending is set to drop by 16.4%.

In a separate move, despite the recent repeal of tax hike measures, the energy regulator revealed on Monday that the road maintenance levy would rise to 25 shillings per liter of fuel, up from 18 shillings, impacting the cost of transportation across the country.

Confronting the most significant crisis of his two-year presidency, Ruto finds himself balancing the demands of lenders like the International Monetary Fund (IMF) to reduce deficits while addressing the struggles of a population grappling with rising living costs.

On Thursday, the IMF stated that it is evaluating recent developments in Kenya, including the government’s budget adjustments and public response to rising living costs.

The organization is considering these factors as it makes necessary adjustments to its engagement with the country, ensuring that its support aligns with the evolving economic landscape.

Got a Question?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.